Starting Your Own Small Business? Read This First.

Starting your own business is exciting, but it’s imperative you set yourself up for success by doing the legal work correctly. Why? In a nutshell, many fail to get the help they need to ensure paperwork and legal matters are handled properly.

As a small business owner, knowing how to operate and organize your business is essential; handling legal matters the right way helps. To ensure your business is legally sound and gain peace of mind, consider consulting with a business attorney prior to establishing your enterprise.

Below are some common legal issues that arise for small business owners:

Failure to Do Taxes Properly.

Always use the right tax forms and keep organized records every year so you’re not scrambling when tax season comes around. Don’t make these common tax mistakes:

- Hiring employees incorrectly: Hiring someone without the correct tax forms or signed contracts is an easy way to get yourself into a costly courtroom situation.

- Failing to track expenses: Keep records of all your expenses so you know what to claim as a tax deduction. Open a separate bank account for business expenses, always keep receipts, and maintain a continuous spreadsheet for costs and earnings.

- Missing tax payments: Failing to file and pay taxes can result in serious consequences, like late penalties and interest. It’s important to stay organized and up to date throughout the year so you can file and pay taxes properly when due.

- Mixing up personal and business expenses: If the IRS discovers you have included personal expenses as your labeled business expenses, you could face costly penalties. This is another reason to open a separate bank account for solely business expenses – it makes things much cleaner and easier when you sit down to do taxes. In addition, it could be considered evidence to pierce the entity veil in a lawsuit to expose your personal assets.

You should consult with a tax attorney, accountant or other tax professional.

Failure to Form a Business Entity Correctly

This is one of the very first, crucial steps of launching your business. A business entity when set up and managed properly can help shield your personal assets from business lawsuits and provide tax benefits. Having a business entity separate from your personal identity conveys a higher level of professionalism. Failure to follow applicable legal requirements can adversely impact your liability protection. If you do not legally register your business in the state you are operating in, you could face monetary penalties or not be able to file a lawsuit if needed.

Business entity selection requires you to consider critical tax and legal factors that can impact your business. Choosing the right business entity and forming it properly is important so that you have the legal protection you need to be successful. It is always recommended to consult with a business attorney before choosing and forming a business entity.

Below are the 3 main types of entities:

- Sole proprietorship: If you start conducting business and don’t file with the state to establish as an entity type, you are considered a sole proprietor. A sole proprietorship does not provide legal liability protection from business debts and actions.

- Corporation: Corporations are legal entities separate from the business owner and can protect the owner’s personal assets (so long as legal requirements are followed) if the corporation is sued.

- Limited liability company (LLC): An LLC protects personal assets from business debt, offers simplicity in management and flexibility in taxation. It can allow you to run your business in a more professional manner.

Unfortunately, agreements made with simple handshakes and verbal agreements don’t cut it in business even if legally binding. For almost every business decision made, a written document signed by both parties is needed. It helps to understand the differences between these written agreements:

- Contracts: Whether it’s to hire someone, purchase or lease equipment, or make other large deals, correct preparation and execution of contracts is critical, as is saving copies for your records.

- Nondisclosure agreements (NDA): The purpose of an NDA is to create a confidential relationship between two parties that aims to protect sensitive business information that may be shared for a particular purpose, while restricting the use and sharing of that information with third parties. Say you come up with an idea for your business that you are pitching to investors. Failure to protect your secret ideas with an NDA puts them at risk of being stolen, which can lead to a costly court room situation.

- Non-compete agreements: Non-compete agreements are designed to restrict an employee, or former employee, from sharing proprietary information or using knowledge of your business or clients to form a competing business. The enforceability of these documents or terms can be an issue to discuss with an attorney.

Not Protecting Your Intellectual Property.

Unfortunately, intellectual property rights are occasionally overlooked, but ignoring them can put businesses into sticky legal situations.

- Copyright: Copyright laws are written to protect pieces of work and authorship. Not only do companies need to copyright their own materials, but they need to pay attention to what they are using from someone else’s intellectual property, like photos, videos or copy.

- Patents: Patents can protect inventions or ideas. You should seek advice and assistance from a patent attorney. They can help to not only protect your rights but help you to avoid on infringing on the rights of others, and thereby sidestep legal battles. On the other end, patenting your own innovation can be essential to prevent others from stealing it.

- Trademarks: You can protect your brand’s name, symbol or logo with a trademark at the federal or state level.

- Trade secrets: As a small business owner, be aware of company information you share and with whom. This will help to minimize risk of misappropriation, which could lead you into a courtroom. This is why the use of NDA’s are so important.

Not Having Access to a Business Attorney.

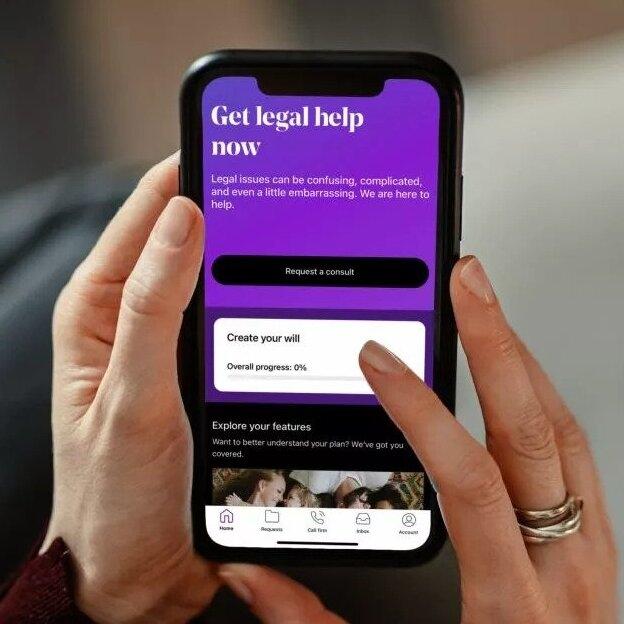

It is important to have access to a business attorney to help you start and manage your business properly and provide the legal protection you need to be successful. A business attorney can provide consultation and assistance with legal issues that arise related to your business and help with contracts and other legal documents.

You don’t have to spend a significant amount of time trying to deal with complex business legal issues on your own. Learn more about LegalShield’s Small Business Plans to get the right level of legal assistance your business needs.

Pre-Paid Legal Services, Inc. d/b/a LegalShield (“LegalShield”) provides access to legal services offered by a network of provider law firms to LegalShield members through membership-based participation. Neither LegalShield nor its officers, employees or sales associates directly or indirectly provide legal services, representation or advice. This is meant to provide general information and is not intended to provide legal or tax advice, render an opinion, or provide any specific recommendations. If you are a LegalShield member, please contact your provider law firm for legal advice or assistance.

Let LegalShield Protect Your Small Business Today.