Renting an Apartment as a College Student

College life is exciting, stressful, and busy all at the same time! Add finding a place to live to your list of things to do, and you may feel like you’ve reached the end of your rope. Renting an apartment can be daunting, especially if this is your first time renting. Whether you are an incoming freshman or a seasoned senior, finding a good student apartment takes time and dedication. That’s why we’ve gathered some of the most critical info for you to know as you start the process!

What do you need to get an apartment as a college student?

Landlords who cater to college students know that you probably have limited income and little history with renting or credit. As a result, they usually need you to fulfill some specific requirements to make sure you are a good fit for their house or apartment. Here is some of the paperwork you should start gathering now:

- Credit score, even if it is low

- Official pay slips or statements from your bank to show your monthly/yearly income

- Social Security number

- Any rental history, including contact info for your past landlords

- Your criminal history if applicable

- References from bosses, previous landlords, teachers, etc.

You will need to contact people for their references and retrieve your official statements from banks, places of work, etc. This paperwork will take time to collect. However, it’s essential that you have it all available to show your prospective landlord so they know you are prepared and productive. The more trustworthy you seem at first, the better your chances are of establishing a good relationship with your landlord later.

How do you get an apartment?

It’s time to start hunting for a great place to live! Here are the basic steps you need to take:

Can you apply for an apartment with no credit?

Remember those important documents we listed earlier that you need to have on hand? What should you do if you don’t have credit at all? Though this might make renting a bit trickier, it does not make it impossible. You still have several options for renting even if you have no credit.

How do you sign the lease as a college student?

The main thing to remember when signing a rental lease is read, read, read. Don’t skip over the fine print. Make sure you understand the terms of your lease agreement. Knowing what you are signing up for will save you massive amounts of confusion, time, and money down the road if you run into problems with the property or your landlord.

These are a few of the basic terms you should be familiar with in your lease before you sign it:

- Cost: What is the price per month? When is rent due? Who is responsible for landscaping, mowing, or other chores? Which utility bills are you supposed to pay, and which ones (if any) will your landlord pay? If you live with roommates, you should understand that whoever signs the lease will be responsible for getting the rent money paid on time. Work out a plan with your roommate for how and when they will pay you their portion of the rent.

- Repairs: Some property damages are the landlord’s responsibility to fix, but some are yours. For example, who is supposed to pay for a handyman to come fix the leaky sink? Probably the landlord. But things get more complicated if you did something to cause the leak! Know who will pay for what ahead of time, and make sure it is documented in the lease before you sign.

- Pets: Your furry friends can impact the overall price of renting a home. Do you have or plan to have dogs, cats, birds, etc.? Make sure your landlord knows this and has worked the pet fees into the agreement. Since animals can cause damage to property, landlords usually charge some extra money for allowing them in the rental home.

Is this your first time renting?

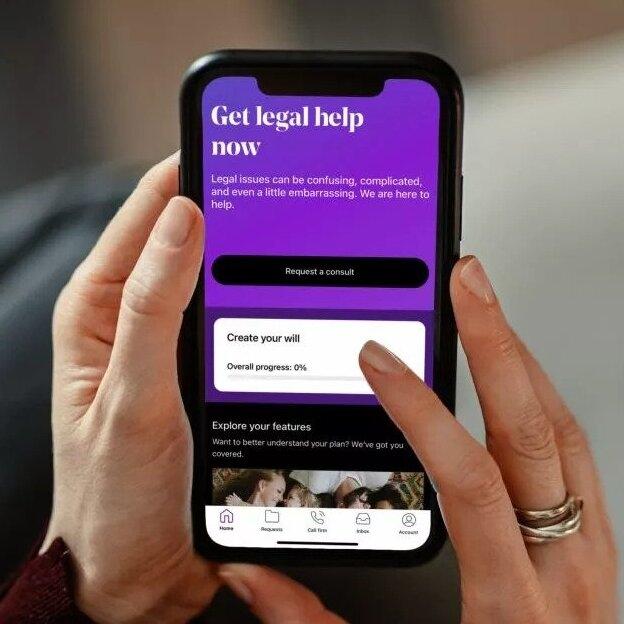

Renting a house, apartment or duplex is a big step in your adult life! You want to do it all correctly. But you may not know where to start. That’s why LegalShield is here to help. For a small monthly fee, you get access to a dedicated provider law firm that is ready to assist with your renting journey. Your LegalShield provider law firm can answer questions, offer advice, review important paperwork, make a phone call or write a letter if necessary, and more, all on your behalf!

As you’re starting your adult life, you’re bound to have many personal legal questions that you don’t know how to answer. Reach out to an independent associate and become a LegalShield Member today!

Pre-Paid Legal Services, Inc. (“PPLSI”) provides access to legal services offered by a network of provider law firms to PPLSI members through membership-based participation. Neither PPLSI nor its officers, employees or sales associates directly or indirectly provide legal services, representation, or advice. The information made available in this blog is meant to provide general information and is not intended to provide legal advice, render an opinion, or provide a recommendation as to a specific matter. The blog post is not a substitute for competent legal counsel from a licensed professional lawyer in the state or province where your legal issues exist, and you should seek legal counsel for your specific legal matter. Information contained in the blog may be provided by authors who could be a third-party paid contributor. All information by authors is accepted in good faith, however, PPLSI makes no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of such information.

Get the power of legal protection