Like anything undertaken for the first time, being a newly-minted landlord comes with a steep learning curve. But unlike other jobs, there is less leeway for mistakes given the potential consequences of missteps or oversights. Here are the top seven tips for new landlord success:

Know tenant/rental laws

Before marketing a rental property, it’s important for new landlords to understand the laws governing the relationship with tenants. Some aspects will be governed by what is contained in the lease, but the agreement terms or the leasing process cannot violate state or federal laws. Below are just a handful of the rules landlords need to be aware of:

- Landlords aren’t permitted to discriminate in renting based upon factors like race, gender, family status or disability under the Fair Housing Act.

- Renters are guaranteed a right to privacy, and landlords cannot enter the property without prior notification (usually 24 to 48 hours).

- Landlords are required to return a security deposit within a period prescribed by state law, and must include a security deposit return letter that details itemized deductions from the amount returned.

- Landlords are required to provide tenants with a safe and habitable living space, and any deficiencies have to be corrected with a certain time period.

In order to ensure your space is safe and habitable for renters, you’ll need to check that the apartment or home is structurally sound; the heating, plumbing, electrical, and air conditioning systems are all in good order; and that you’ve provided the necessary security measures like locks, smoke and carbon dioxide detectors, and rails for stairways.

Make sure you’ve done your research on tenancy laws in your area and it’s prudent to speak with a real estate attorney experienced in this area before renting out your property.

Research potential renters

Screening applicants is a vital step in the rental process, and not to be cast aside based upon eagerness to fill the space or a good feeling from a face-to-face meeting. The rental application process affords an opportunity to check credit and references, and you should take advantage of that opportunity. Checking an applicant’s credit and background (for which you need permission) will give you a credit history and show any bankruptcy proceedings, criminal or civil issues, and give you greater context by which to judge a potential renter.

The best way to deal with tenant issues in the beginning, and particularly as a new landlord, you want to find responsible tenants who will pay their full rent on time. And while it’s on your tenants to fulfill their end of the bargain, it’s also smart to recommend that tenants sharing the space have a roommate agreement to divvy up responsibilities and obligations, lest their issues end up becoming yours.

Put it all in writing

Perhaps an obvious point, but regardless: in renting to a tenant, you should have a written, signed lease plus all communication should be in writing, including follow up to meetings or property visits. Oral leases may be upheld in your state if the term is less than a year, but a written agreement removes any of the doubt or dispute over what was agreed to initially. In order to protect yourself, the lease should not only contain key terms and clauses covering every contingency but also be specifically tailored to the individual and the particulars of the arrangement. Your lease safeguards against conflict and disagreement, provided it is thorough and in accordance with state law. In that vein, you should have a record of all correspondence between you and your tenant(s) to avoid conflicts or disputes.

Keep detailed records for legal and financial/tax purposes

Renting property may be a different kind of business than what you’re used to, but it is a business nonetheless, and every well-run business requires complete records to avoid potential problems. Every rent payment, repair bill, and expenditure should be kept and catalogued for future reference against the day when a potential tenant dispute might arise, in addition to the basic requirements for tax and reporting purposes.

Be prepared to meet obligations

It’s easy to focus on preparing your property to rent and then finding the right tenant, but what happens after the lease is signed? No landlord goes in believing that a renter and rental property can be put to the back of their mind, but are they truly prepared for the work that is required to meet the responsibility of being a landlord, and the potential cost? Much of the work may be relatively simple fixes, but as with any property, big things can go spectacularly wrong, and fixing them might be hundreds if not thousands of dollars out of your pocket.

Have insurance and require insurance

Speaking of preparation, no landlord should start renting a property without considering landlord insurance. Landlord insurance provides protection against both property damage and liability, meaning that you won’t be paying out of pocket in the event of things like a fire or if your tenant suffers a personal injury that is your responsibility. Likewise, you can require tenants to have renters insurance to cover any potential damage or loss of their personal possessions in the event of disaster or theft.

Make regular inspections that honor tenants’ rights

In order to ensure that everything on the premises is working correctly, and that your tenant hasn’t caused any damage that would violate the terms of your lease, you should make periodic inspections of the property. You can’t drop in unannounced, however; tenant privacy laws stipulate that you have to give fair warning before entering (typically 24 or 48 hours at least). Also, note that too-frequent visitations might qualify as harassment or a violation of your tenant’s right to privacy.

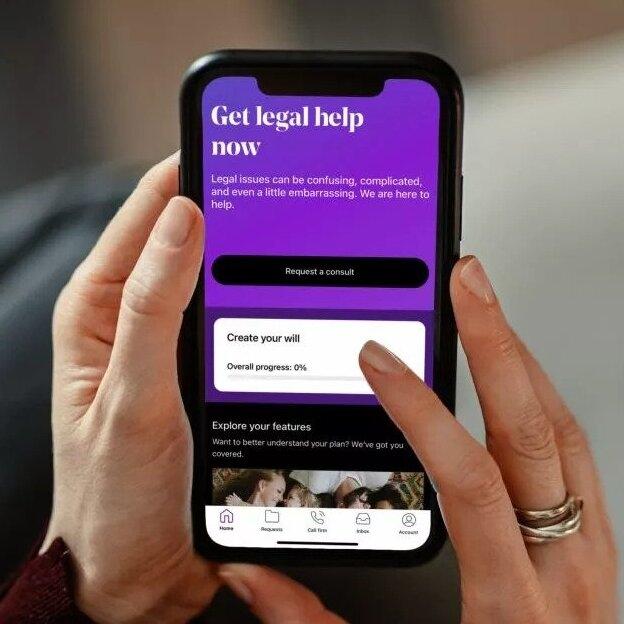

Crafting a lease, or managing any of the other questions that arise as a first-time landlord, requires a level of knowledge that you don’t yet possess. Fortunately, LegalShield members can get advice and consultation from an real estate expert provider attorney within 24 hours as well as lease review, all included in the price of membership.

Get Legal Support for Your Rental Business