Protecting Yourself from a Bad Lease

Amid the flurry of registering for classes and ordering textbooks, many college students may have rushed through the important transaction: leasing an apartment.

After spending days searching rental websites and touring apartments, students and other renters are tempted to snatch the keys from the landlord and sign whatever lease is put in front of them. But a lease shouldn't be taken lightly; it’s a legal document that outlines both their rights and responsibilities and all renters need to fully understand the terms of the lease before they agree to them. Student renters should also know that leases can be negotiated, particularly for those renting private apartments instead of university-affiliated dorms — an increasing trend according to the Los Angeles Times.

The Fundamentals of a Lease Agreement

The residential lease agreement is between the owner/manager of a property (known in legalese as the “lessor”) and the tenant (the “lessee”) to establish the terms of the tenancy. Here are a few of the typical elements of a residential lease and some of the more nuanced provisions to look out for in the paperwork.

A lease should always delineate these basic elements:

- Names and contact information of both the lessor and the lessee(s); any roommates need to be included on the lease so they are held to the same requirements;

- Address of the property (including unit number) and a basic description of the property to be rented;

- Length of the tenancy (with specific dates, typically amounting to a year);

- The amount and due dates of monthly rent, as well as timelines and penalties for late payment;

- Whether the landlord is responsible for paying utilities (and if so, whether he/she will set limits upon your utility usage);

- The amount, due date, and conditions for the return of a security deposit;

- Rules and any associated fees/security deposits for pets, smoking, etc.;

- Responsibility for repairs and general upkeep of the property.

These items are the basic requirements for a residential lease. If you find any of these terms to be missing from your lease, consider it a red flag and bring it up with the property owner or manager immediately.

Watch out for Lease Nuances.

You or your landlord may want more than the bare minimum provisions in your lease agreement. If you see one of the clauses below in your lease, make sure you understand it fully before signing. If you don’t see one of these in your lease and want it included, negotiate the agreement to include it before you sign.

Lease break procedure and fees: Landlords and management companies often charge a fee for the early termination of your lease (from a couple of months’ rent up to the entire rest of the rent due for the lease term). However, many states require a “duty to mitigate,” meaning landlords must make a reasonable effort to re-rent the property and eventually release you from your financial obligations.

Automatic renewal clause: Some agreements will stipulate that you are expected to leave the property on the end date of the lease, and others will state that the lease is automatically renewed (often on a month-to-month basis thereafter). Pay attention to which (if any) of these are included in your lease, as well as whether you must provide written notice of the intent to move (and how long that notice must be, such as 30 or 60 days).

Modifications: If you have your heart set on red dining room walls, you’ll want to check whether the lease has any provisions about making significant changes to the property. Sometimes exceptions can be made ahead of time, but make sure that before you start painting or knocking down walls, you get it in writing in the lease.

Sublet provisions: Summer internship, a sudden career change, a crazy roommate: there are dozens of reasons why you might end up wanting to sublet your place for a few months. Many residential leases have provisions — voidable by state law in some cases — that permit subletting and outline any related protocol. They may answer questions like: Does your roommate have to agree to have a subletter? Do they get any discretion over who you sublet to? To whom does the subletter pay monthly rent? Read these carefully, because it could mean the difference between recouping your rent or losing it entirely.

Damage and destruction clause: Damage and destruction (D&D) clauses spell out if and how a landlord would be responsible in case of a natural disaster. If you’re not sure whether to get renter’s insurance, the terms associated with this clause may help you to choose one way or the other.

Sign and Seal It.

Once you’ve carefully read over your lease and made any necessary changes, make sure you, your landlord, and any roommates you may have added their signature to the lease (if a roommate’s name is not on the document, they are not legally liable for the rent). If you’re unsure about anything included in the lease, speak to an attorney to get professional advice before making any decision. And finally, keep a copy of your lease for future reference and rest easy in your new digs knowing that you fully understand every word of it.

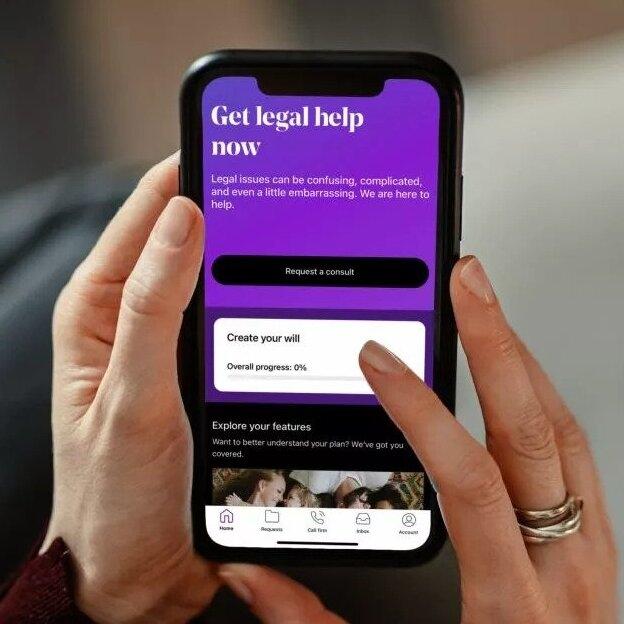

LegalShield is here to help!

Sign up today and speak with an attorney in your area about Landlord-Tenant Laws and have them review your lease.

LegalShield provides access to legal services offered by a network of provider law firms to LegalShield Members through member-based participation. Neither LegalShield nor its officers, employees or sales associates directly or indirectly provide legal services, representation or advice. See a plan contract for specific state of residence for complete terms, coverage, amounts, and conditions. This is not intended to be legal or medical advice. Please contact a medical professional for medical advice or assistance and an attorney for legal advice or assistance.

Sign Up Today and Speak with an Attorney in Your Area about Landlord-Tenant Laws