What To Do If You Receive a Questionable or Outrageous Medical Bill

Let’s be real, medical costs in the United States are both expensive and complicated. Navigating the healthcare system with its co-pays, insurance, and Medicare regulations is often confusing at best. However, it’s a different issue when you receive a medical bill that you absolutely did not expect because either it’s not yours or it’s an astronomical amount or both.

Dealing with a surprise medical bill can be stressful but remember to keep all your documents and deal with everything in writing so you can seek legal help when you need it.

Is This a Billing Mistake or Fraud?

Let’s define the difference between an error and potential medical billing fraud. A clear mistake would be to get a medical bill for services in error; perhaps you did not receive the services that are listed on the invoice on that date, but the same procedures were done on another date.

However, if you are receiving a bill for procedures when you were not the patient or the billings seem somewhat familiar to you in terms of the date and provider but list services that exceed what you recall, it may be some type of fraudulent scheme and it’s best to consult with a lawyer rather than trying to resolve on your own.

How to Contest Your Bill

It’s understandable that when the medical charges are the result of an emergency or accident that you may not have been involved in the admitting process or may not remember due to the stressful nature of the situation. Regardless, start by gathering all the relevant documents from the medical provider and any insurance information and then review your position before reaching out to discuss the billing.

Hopefully, you have all the information associated with the incident. Today, we often complete computer forms and electronic authorizations, but you should be able to request copies of anything that you filled in by hand or online. Once you have assembled and read everything, you should have a better understanding of what you agreed to when the medical services were delivered.

It may be best to first contact your insurance company to see if they have covered the correct amount with the medical provider. For example, there may have been a mistake on a billing code or not enough information sent to the insurance company. Next, you can reach out to the medical provider to discuss any potential errors or mistakes.

Keep detailed notes of all your conversations and where possible, use any online chat function that can then be downloaded as a record. If you are speaking with an individual on the phone, follow up with an email to confirm the understanding of your phone call.

Once you know the proper amount owed, you can then decide whether you wish to dispute the amount or work out a payment plan, or both. At this point, you may wish to involve a third party or lawyer to help out.

Legal Options

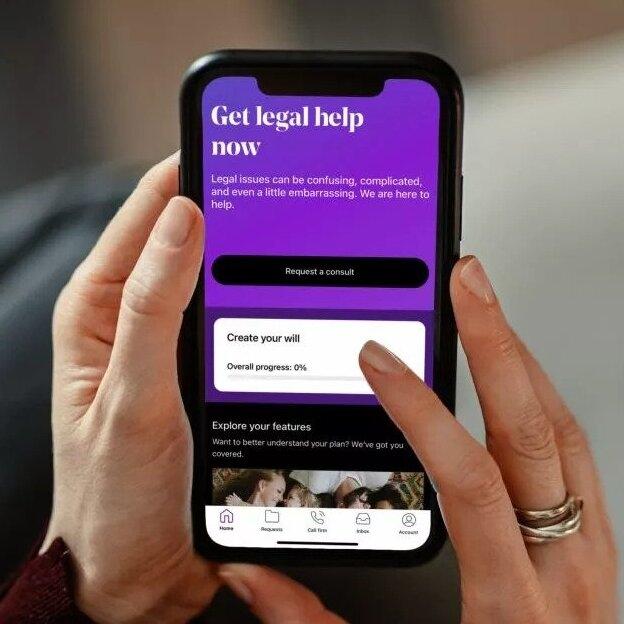

A LegalShield lawyer can assist with your negotiation in several ways:

- Review your documents and interpret the billings and insurance

- Make calls or write letters on your behalf to resolve the matter

Finally, it’s critical that you don’t ignore any demands for payment, regardless of how outrageous the bill might be, because the medical provider may send the matter to collections which can impact your credit.

Certainly, receiving a surprise or incorrect bill will be stressful but with LegalShield, you don’t have to skip a lawyer due to the cost. For only $29.95 a month you can work with a lawyer on your medical bill questions and concerns, with phone consultations and document review on any pressing issues. Sign up today to make sure you and your family are protected.

Pre-Paid Legal Services, Inc. (“PPLSI”) provides access to legal services offered by a network of provider law firms to PPLSI members through membership-based participation. Neither PPLSI nor its officers, employees or sales associates directly or indirectly provide legal services, representation, or advice. The information available in this blog is meant to provide general information and is not intended to provide legal advice, render an opinion, or provide any specific recommendations. The blog post is not a substitute for competent legal counsel from a licensed professional lawyer in the state or province where your legal issues exist and the reader is strongly encouraged to seek legal counsel for your specific legal matter. Information contained in the blog may be provided by authors who could be a third-party paid contributor. All information by authors is accepted in good faith, however, PPLSI makes no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of such information.

Get the Power of Legal

Protection

Personal Plans Start at Only $24.95/month.