It’s an unavoidable fact of life that many, if not most of us, put off the difficult and unpleasant chores of life, particularly those involving lots of paperwork. That’s perhaps even more true for those things we don’t fully understand; it’s easier to ignore something than to try and wrap our heads around it, and estate planning typically falls squarely in that category. Most have a general notion of estate planning and Wills, but not a full understanding of what’s involved, and for that reason we avoid it. In dispelling some of the myths, you can feel more confident in knowing what you need to do in creating your estate plan, and what you should look out for.

Estate planning myths debunked

Perhaps the biggest myth surrounding estate planning is that it’s not for you; it’s for the wealthy, those with considerable assets to give away when they pass. While you may be by no means rich, that doesn’t mean you don’t have assets and property to your name, and you want to pass that property on to your family. Your home and all the possessions you’ve collected over the years have both sentimental and real value; one that you do not wish to leave in the hands of the court to pass on.

A related myth is that failing to create a Will means that your property will end up with the government. While some part of your estate may go to creditors if you die with outstanding debts, the lack of a Will won’t prevent your most direct family member from getting your house and other assets after your die, simply that it will likely take longer to go through the probate process, and that the ultimate distribution of your things might not go as you would have intended had you left instructions.

Even if you do leave a Will with your wishes for how your assets are to be handed out, and to whom, you might be wrong in assuming that your decision will be agreed upon and respected by your family. A beneficiary who feels wronged or unfairly left out of your Will might want to try and contest that Will in court. However, there is a somewhat high bar to meet to have both standing to challenge the Will and a legally valid reason to have it overturned that passes the scrutiny of a court.

When contesting your Will—to start—an individual would have had to be named in your Will, or in a previous version of the Will, or are a family member who would have stood to inherit property if the Will didn’t exist, like a child or spouse. Beyond that, they would have to be able to demonstrate that your Will isn’t legally valid, whether due to the factors that include: you weren’t mentally competent or under some type of duress when it was created and signed; it doesn’t have the requisite witness signatures or isn’t the most recent version of the Will.

Issues with the Will can arise when people try to create their own Will, or use a Will from a template. It might seem like a time- and money-saver and is within your rights to do so, but trying to DIY your Will might create more problems than it solves. A Will does have to meet certain criteria to be considered legal, as noted previously, but it also should cover all your assets and all the potential contingencies, as well as any estate tax implications, and to get it right requires professional help from an attorney.

Help is particularly needed if your Will includes instructions or stipulations outside of what would be considered normal. Family situations can be complicated; remarriages can create new beneficiaries, and that same marriage can sour other relationships. If there are family members that you want to leave out of your Will, you need to be sure you can do so in a way that won’t result in a contested Will. There’s also the question of what items go to which people; while you might not be concerned with specifics beyond bigger items like cars or homes when it comes to inheritance, you might have smaller items of personal significance that you want to see go to family for whom the items will have more meaning, like family heirlooms or jewelry.

The constant changes in your life highlight the fallacy that your Will is something to be done once, and then set aside for your eventual death. If you’re crafting a Will as early as you should, you’re going to gain more property, sell off some items, buy and sell homes, and add or lose family members who you would have as beneficiaries in your Will. Changes to your life necessitate changes to your Will. Otherwise, things are left to the probate process to determine.

Get Started with Your Estate Plan

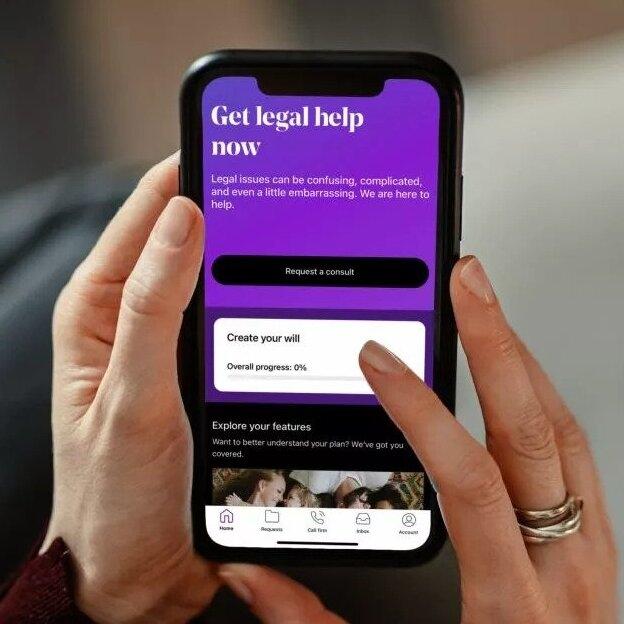

Estate planning can be a bit complex, sure, but it’s necessarily so to account for our complicated lives and the assets and people we’ve acquired (or lost) along the way. Understanding what’s involved, and what issues can arise from an incomplete or incorrect Will, or from not having a Will at all, should serve as motivation to tackle estate planning sooner rather than later. Our LegalShield attorneys are available to answer any questions on estate planning; individual plans start at $24.95 and include a basic Will.

LegalShield provides access to legal services offered by a network of provider law firms to LegalShield Members through member-based participation. Neither LegalShield nor its officers, employees or sales associates directly or indirectly provide legal services, representation or advice. See a plan contract for specific state of residence for complete terms, coverage, amounts, and conditions. This is not intended to be legal or medical advice. Please contact a medical professional for medical advice or assistance and an attorney for legal advice or assistance.

Speak with a LegalShield Attorney Today and Start Your Estate Plan