Choosing Between Buying and Leasing Business Equipment.

Your business needs the right tools for success, but that equipment can represent a considerable outlay and investment for small businesses without significant resources. Every financial decision is an important one, and every dollar potentially wasted is money not going towards any of the company’s other pressing needs. That’s why the decision to lease or buy equipment is important and one not to be taken lightly.

Every startup’s financial situation and needs are different, so there’s no one pat answer in the lease versus buy analysis. In making a decision, you have to consider the benefits of each, as well as the potential drawbacks.

Leasing Your Small Business Equipment:

When you lease equipment, you’re avoiding making a long-term commitment; your obligation only extends as far as the months on the agreement, and often there is a buy-out amount as an option. That offers greater flexibility if you need to find equipment that is better or perhaps cheaper in the future, or if you no longer need that item.

Leasing is also an easier option for those who don’t have the money to buy equipment outright and offers the certainty of monthly costs that can be more easily absorbed than one lump sum. And the monthly payments can likely be claimed as a business expense.

Leases may have flexibility in the payment terms of the agreement, offering a chance for those with poor credit or less money a longer term to pay for the equipment. And the leasing company is usually responsible for the cost of normal repairs.

While you gain flexibility, you lose out on some value. Particularly if you’re not leasing to buy because none of the money paid puts you any closer to owning the equipment. In comparison with purchased equipment, there may be a chance to recoup some of the money through resale. And most leases require you to pay a premium on what would be the amortized cost of buying the same equipment, so over the course of years it’s usually a more expensive proposition. Finally, while you may be able to negotiate the length of a lease, you might still end up with a longer lease than you need and still be on the hook for payments.

Buying Your Small Business Equipment:

When owning purchased equipment, it’s yours to do with as you please, without the possibility of having it taken back by a lessor. You can find the exact right equipment for you, avoiding restrictions by the leasing company. Also, you can use or alter your new equipment to suit your needs without worrying about the terms of a lease. And for equipment that has a useful life extending years beyond a normal lease term, you’ll have what you need. Finally, at the point it passes its usefulness, you can resell to make back some of the money you spent, even if it’s only a fraction.

A purchase commitment does pose its own challenges. Most leases offer the possibility of changing and upgrading equipment year-to-year; with purchasing, you’re committed to that model. A considerable upfront cost can also prevent you from getting exactly what you want or need if you’re buying, with price forcing you to settle for a less-expensive option. And the equipment you own is the equipment you’re responsible for repairing (outside of any warranty), at whatever the cost. Purchasing equipment also means committing considerable money upfront, possibly at a time when your new business’ long-term viability is far from assured.

Deciding between leasing and buying requires weighing your short and long-term costs against the gains in revenue from having the right kind of equipment. You need the correct tools to perform to your best, and any decision is going to be a bet on your company and your team to succeed in the actual work to justify the expense. A professional can help you evaluate the options and a LegalShield attorney should review any lease or purchase agreement as part of your plan.

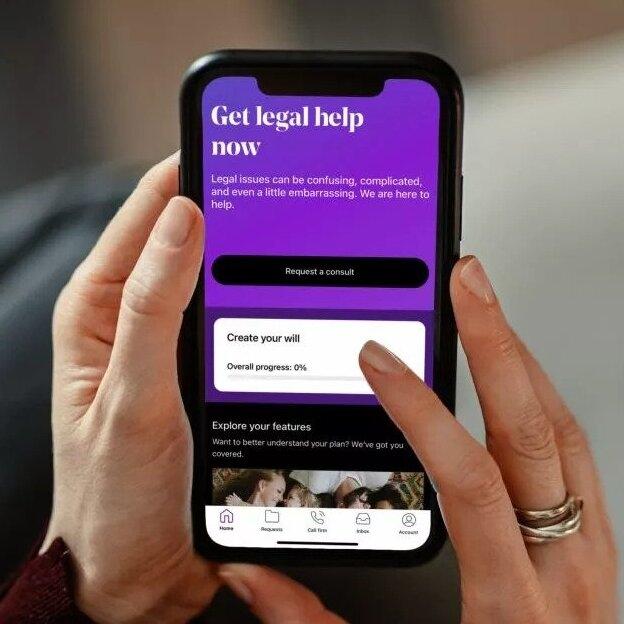

Launch by LegalShield if here to help!

Launch by LegalShield and the SMB plan can help you with the hard decisions that come with starting a business. Get started with Launch today.

LegalShield provides access to legal services offered by a network of provider law firms to LegalShield Members through member-based participation. Neither LegalShield nor its officers, employees or sales associates directly or indirectly provide legal services, representation or advice. See a plan contract for specific state of residence for complete terms, coverage, amounts, and conditions. This is not intended to be legal or medical advice. Please contact a medical professional for medical advice or assistance and an attorney for legal advice or assistance.

Speak with a LegalShield Attorney to learn more about Your Options.