More than Half a Million Consumers are Going into Debt This Holiday Season. How Can You Stay in Control of Your Finances This Season?

'Tis the season for overspending.

While Americans are reportedly spending less on holiday shopping than in previous years, more than half a million people are still spending more than they should.

In fact, many shoppers are flocking to the “buy now, pay later” option at checkout and according to Oxygen, 56 percent of shoppers made a BNPL purchase they couldn’t pay off.

When it comes to playing Santa, how far is too far?

Overspending and going into debt is nothing new for many Americans during this time of year. What is it about the holidays? Why do we spend so much money? Well, there are multiple reasons.

There are tempting sales in every store, and retailers seem to come at you from every corner with the perfect gift for the ones you love and, of course, a little something for you, too. On top of purchasing gifts for everyone, you may want to buy holiday decorations for your home, give generously to charities or the community, purchase new clothes for all the holiday parties, and pay for pricey travel expenses to go home in time for Christmas.

While this time of the year can be exhilarating, it can also be overwhelming to your wallet. So how can you take power over your finances this holiday season?

7 tips to control your holiday spending

Learn how to stay focused this season but still get everyone you love a special gift:

- Set a realistic budget. Give your credit card a holiday break of its own by planning your spending budget. List out everyone you plan on getting a gift for and set a realistic budget that works for you. It’s also a great idea to talk about budget options with your family, friends, or colleagues, so you’re all on the same page.

- Give thoughtful gifts versus pricey ones. Not every great gift needs to have an expensive price tag attached to it. Find creative ways to give a kind and special gift to people you love. For example, let’s say your sister is getting into baking. Get her a cute apron or some festive sprinkles! You can even find a personalized rolling pin with her name on it for $15 for a gift that’s sweet, thoughtful, and won’t break the bank!

- Coupons, coupons, coupons. And sales! Try to look for good deals and promotions every day of your shopping period instead of just Black Friday and Cyber Monday because retailers may have more and even better sales on items throughout the entire month of December.

- Create a shopping list and stick to it. Once you’ve figured out the perfect gifts for everyone you love, write out exactly what you need to buy. Figure out where to get these items and how much they are and write that down. As you purchase items, try not to get distracted by other tempting goodies in the stores and stick with your list.

- Create a ‘naughty and nice’ list. We want to buy gifts for everyone we know – family, friends, neighbors, co-workers, teachers, etc. But sometimes getting every single person a present isn’t in your financial cards. Instead of getting everyone a gift, bake a batch of cookies and make baggies to hand out to people who aren’t on your immediate list of loved ones. A sweet batch of baked goods goes a long way, and it’s an excellent method to spread the Christmas cheer around.

- Start early. Or at least start planning early. Figure out what you’re getting everyone so that you can keep an eye out for the best deals and sales on your shopping list. People tend to overspend during the holidays because they wait to the last minute to buy gifts and end up going on a shopping spree after all the sales and promos have expired.

- Presence is a present. When setting your budget for the holidays, keep in mind that travel is also expensive, and there’s no greater present to your family than being home for the holidays. Make sure to account travel expenses into your spending budget this holiday!

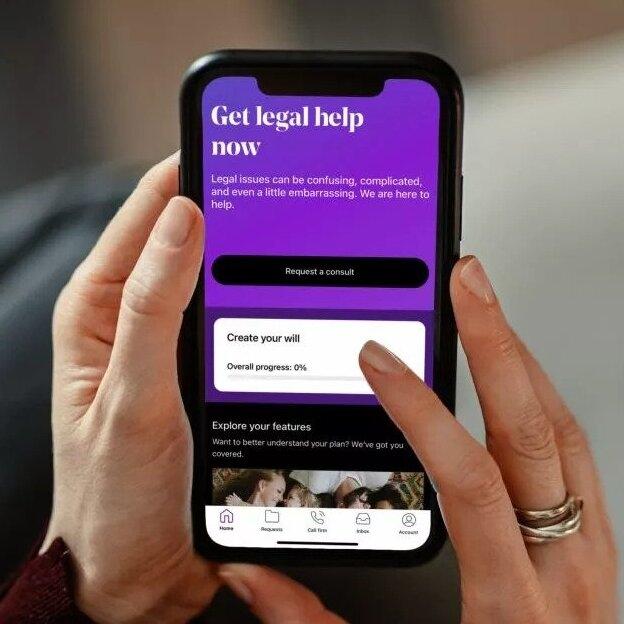

Talk to your provider lawyer for all consumer finance needs.

The holidays are in full swing, which means consumer legal matters are, too. If you do find yourself in debt, talk to your provider lawyer about your financial legal matters this holiday season to understand how best to resolve them.

LegalShield provides access to legal services offered by a network of provider law firms to LegalShield Members through member-based participation. Neither LegalShield nor its officers, employees or sales associates directly or indirectly provide legal services, representation or advice. See a plan contract for specific state of residence for complete terms, coverage, amounts, and conditions. This is not intended to be legal advice. Please contact a lawyer for legal advice or assistance. If you are a LegalShield member, you should contact your Provider Law Firm.

Get Answers to your Legal Questions About Your Consumer Finance Rights This Holiday Season.