How to set up LLC for Governance

Corporations have existed as a business structure for hundreds of years, and the laws governing them have developed over time. The Limited Liability Company (LLC), on the other hand, is a relatively new type of business entity, and the law on how LLCs ought to be handled in complicated situations is still developing. However, the LLC combines attributes of a corporation and a partnership, but the governance requirements for an LLC are much less onerous.

As with incorporation, a first step in creating an LLC is deciding upon a name. The name of the LLC itself doesn’t have to be the name you will use for your business. In other words, if you plan to use a DBA (doing business as) to operate under a different name than the LLC, then the LLC name does not have to be the same as your business’ name. Nevertheless, it’s still required to find a name that doesn’t conflict with an existing LLC name in your state.

Required: Certificate of Organization

The required governance document for every LLC is a Certificate of Organization, which might also be called the Articles of Organization. This document is required for LLCs, as a state will not recognize your LLC entity without having it. You must file your Certificate of Organization with the state and pay any mandatory filing fees in order for your LLC to be recognized. It’s advisable to have an attorney assist with the LLC formation and filing with the state.

So what kind of information is included in the Certificate of Organization? Each state might differ slightly, but the general requirements are:

- Name of the LLC

- Purpose of the LLC & Description of the company’s business

- LLC’s Address (both principal and mailing)

- LLC’s Duration

- Registered Agent Information

- Management Structure Type (single manager, multiple managers, all members managers)

The Registered Agent is someone selected to accept legal papers on behalf of the LLC, and can be a member of the LLC or an individual or company acting on the LLCs behalf and likely needs to be located in the same state as the LLC.

Additional requirements from some states might include a list of all members of the LLC, a limitation of liability clause, or the initial monetary contribution to the LLC. An LLC may also have to file an annual report with the state.

Although a standard Certificate of Organization form with the specific requirements for your state is available online, some of the choices, including agent and type of management structure are best first discussed with an attorney. After filing, provide your Certificate to your registered agent.

Needed: Operating Agreement

Beyond the required governance documents, you should create an operating agreement with an attorney. It is not mandatory for you to file an operating agreement with the state, and in some states, it doesn’t even need to be in writing. But, the operating agreement is likely the most important part of LLC governance because it helps avoid complications and even lawsuits.

The purpose of the operating agreement is to outline how the LLC will be run, much like corporate bylaws or a corporation’s articles of incorporation, and is where you set out the rules for governing the entity.

The operating agreement will cover:

- LLC’s managers and members functions

- Procedure for calling members’ meetings

- Voting procedures

- Tax and financial guidelines, such as tax classification

- Rules for issuing and transferring capital interests

- Handling of profits (and losses)

- Conditions and Procedures for dissolving the LLC

Together, the items in the operating agreement create a structure for governing the LLC, and must always be consistent with information in the Certificate of Organization, which takes legal precedence. You will also want to include a procedure for amending the operating agreement inside the document itself, as well as clauses protecting members and/or officers, and a severability clause in the event that any particular part of the agreement is invalidated. This operating agreement is something that you should not do yourself as it can have severe consequences as you run your business.

Finally, in order for the LLC to do business, you’ll need an Employer Identification Number (EIN) from the IRS, as well as any business licenses required by your state and locality. You’ll also need to file with the state in order to pay sales and employer taxes, in addition to any fees required when filing the required annual report from your LLC. All of these tasks can be supported by a LegalShield attorney.

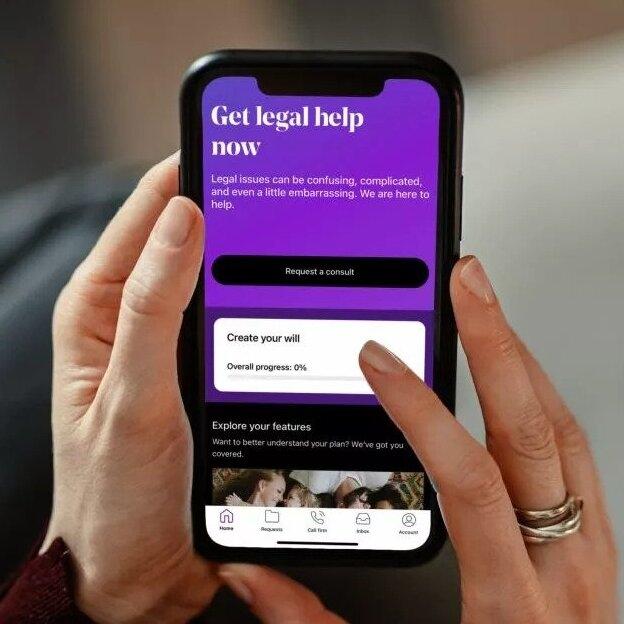

Get Started Today!

Let Launch by LegalShield handle all the necessary filing and paperwork for your LLC.

LegalShield provides access to legal services offered by a network of provider law firms to LegalShield Members through member-based participation. Neither LegalShield nor its officers, employees or sales associates directly or indirectly provide legal services, representation or advice. See a plan contract for specific state of residence for complete terms, coverage, amounts, and conditions. This is not intended to be legal or medical advice. Please contact a medical professional for medical advice or assistance and an attorney for legal advice or assistance.

Start Your LLC with LegalShield Today!